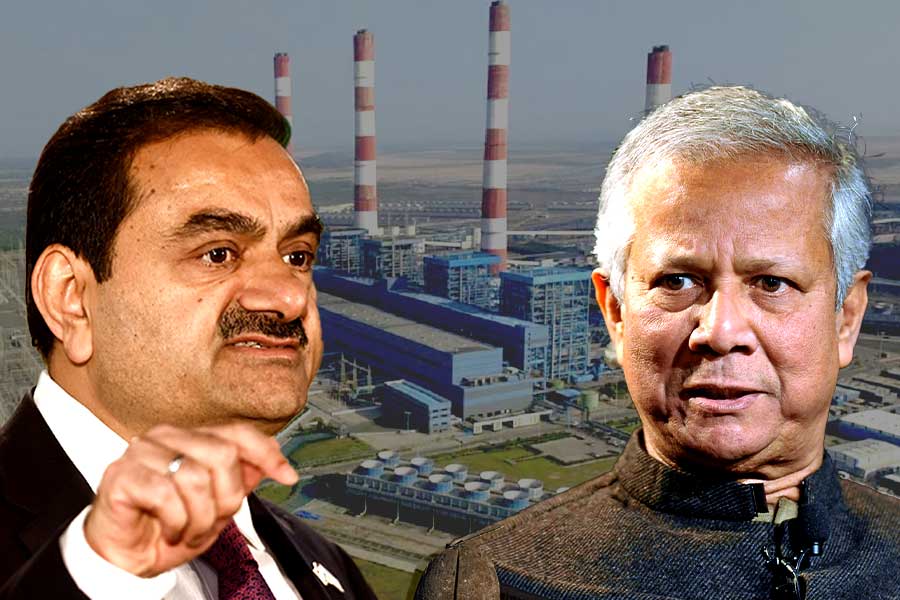

Bangladesh Pays $384 Million to Adani Power, Cuts Dues to $500 Million Under 2017 Energy Deal

Bangladesh has made a significant financial move by substantially clearing its dues to Adani Power, a development that could influence the country’s long-term energy relations with India and billionaire industrialist Gautam Adani. In June 2025, Bangladesh paid $384 million to Adani Power as part of a larger commitment of $437 million, according to sources familiar with the matter. This payment clears all admitted dues till March 31 and brings down the total outstanding dues to around $500 million, assuming the remaining monthly commitment is met. The total billed amount by Adani Power to Bangladesh stands at approximately $2 billion, out of which nearly $1.5 billion has now been paid.

This significant payment is seen as a step towards restoring financial trust between the two entities, following a challenging period marked by Bangladesh’s struggle to meet its financial obligations. The original agreement with Adani Power was signed in 2017, when Sheikh Hasina’s government inked a 25-year power purchase deal under which electricity generated from Adani’s Godda power plant in Jharkhand would be exclusively supplied to Bangladesh. However, the economic pressures following the Russia-Ukraine conflict in 2022, coupled with widespread student-led protests, severely strained Bangladesh’s financial position. These events culminated in political instability and the eventual ouster of Sheikh Hasina, who reportedly fled the country on August 5, 2024.

In response to the payment defaults, Adani Power halved its electricity supply to Bangladesh in November 2024. The full supply of 1,600 MW was only resumed in March 2025 once Bangladesh began making regular monthly payments. The Godda power plant, which is coal-fired, remains the central asset in this bilateral energy deal, and its supply is vital for Bangladesh’s electricity needs.

Following Sheikh Hasina’s exit, the interim government under Muhammad Yunus has called for greater scrutiny of such international agreements. A high-level committee comprising energy and legal experts has been formed to re-evaluate the Adani power purchase agreement, which the new administration considers opaque. Despite this, the recent payments signify Bangladesh’s intention to honor its contractual obligations while continuing to review past deals for transparency and long-term sustainability.

Bangladesh’s foreign currency reserves have been under pressure, affecting its ability to pay for essential imports such as electricity, coal, and oil. In light of this, the interim government has sought an additional $3 billion loan from the International Monetary Fund (IMF), supplementing the earlier $4.7 billion bailout package. The IMF funding is expected to offer some cushion to the economy, allowing it to stabilize and continue making timely payments under international energy agreements.

Besides Adani Power, other Indian power entities such as NTPC and PTC India Ltd. also have active power supply arrangements with Bangladesh, reflecting the deep energy cooperation between the two nations. However, the Adani deal remains the most high-profile and financially significant, drawing both attention and scrutiny amid Bangladesh’s political and economic transformation.

For video news, visit our YouTube channel THE OLIGO.