Investor Faces Rs 74,000 Tax on Rs 7 Lakh Stock Market Profit Due to Misunderstanding Income Classification

Tax Expert Reveals How Rs 7 Lakh Stock Market Profit Triggered Rs 74,000 Tax Shock for Investor

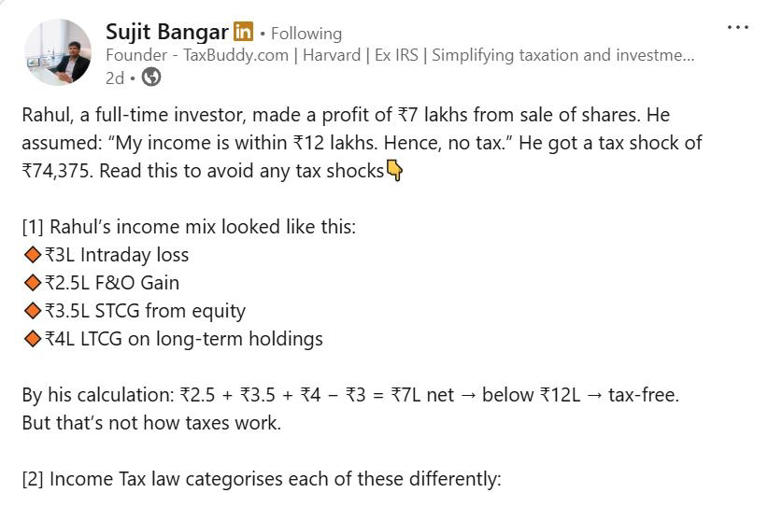

A recent real-life case shared by Sujit Bangar, founder of TaxBuddy.com and former IRS officer, has sent shockwaves among retail investors after it highlighted how a seemingly modest Rs 7 lakh profit from the stock market turned into a hefty tax demand of Rs 74,375. This case serves as a crucial wake-up call for millions of individual traders and investors who often misinterpret tax laws by treating their total earnings as a single figure, without considering the detailed classifications and rules under India’s complex income tax system.

Bangar took to LinkedIn to share the case of an investor named Rahul, who believed he was on the safe side of taxation because his total income was below Rs 12 lakh. Rahul assumed that after deducting his losses, his net Rs 7 lakh profit would fall under the exemption limits and wouldn’t attract any major tax liability. However, he overlooked one of the most important principles of Indian taxation — different types of market income are treated and taxed differently, each with their own distinct set of rules, exemptions, and set-off conditions.

Rahul’s total income composition was a mix of various types of market gains and losses: a Rs 3 lakh loss from intraday trading, Rs 2.5 lakh gain from futures and options (F&O), Rs 3.5 lakh in short-term capital gains from equities, and Rs 4 lakh in long-term capital gains from listed stocks. Instead of calculating tax based on each income category, Rahul pooled all these figures together and assumed he owed very little in taxes. That mistake led directly to the shock tax bill.

Bangar explained that intraday trading losses fall under speculative business income and are taxed at the individual’s slab rate. Critically, such losses can only be set off against speculative income, and if not adjusted in the same year, they can be carried forward for up to four years. Futures and options trading is treated differently — it is categorized as non-speculative business income under Section 43(5) and is also taxed at slab rates. The benefit here is that F&O losses can be set off against any income except salary, and can be carried forward for up to eight years.

Then come the capital gains. Short-term capital gains (STCG) from equities — where stocks are sold within one year — are taxed under Section 111A at a flat 20%. No basic exemption is allowed here, and though STCG losses can be adjusted against both long- and short-term capital gains, many investors don’t realize that this category doesn’t merge with other income types. On the other hand, long-term capital gains (LTCG) from listed shares fall under Section 112A. These gains are taxed at 12.5% after a basic exemption of Rs 1.25 lakh, and losses here can only be set off against other LTCG.

The crux of the matter, as Bangar warned, is that income earned from the stock market must be broken down by type — speculative, non-speculative, short-term capital gains, and long-term capital gains. Each has unique tax treatment. The common investor mistake is aggregating them all and assuming that standard deductions or slab exemptions will apply uniformly. Unfortunately, that assumption doesn’t hold true under the Income Tax Act.

Rahul’s case is not unique. With the surge in retail investors using app-based trading platforms, many are unaware of the intricate tax implications tied to their market activity. The increase in trading has not been matched by a rise in tax awareness, and as a result, unexpected tax bills are becoming more common. Bangar further clarified that the popular Section 87A rebate — which allows for a tax rebate of up to Rs 12,500 for individuals earning under Rs 5 lakh — does not apply to long-term capital gains under Section 112A. This further narrowed Rahul’s scope for tax relief.

The key takeaway from this case is simple yet vital: investors must understand the exact nature of each income type they earn from the market. A low total income does not automatically translate to a low tax burden if it includes earnings subject to special tax rules. Sujit Bangar’s message is clear: “Don’t confuse low income with low tax. Understand how each income is classified and taxed.”

For video news and more detailed explanations, visit our YouTube channel THE OLIGO