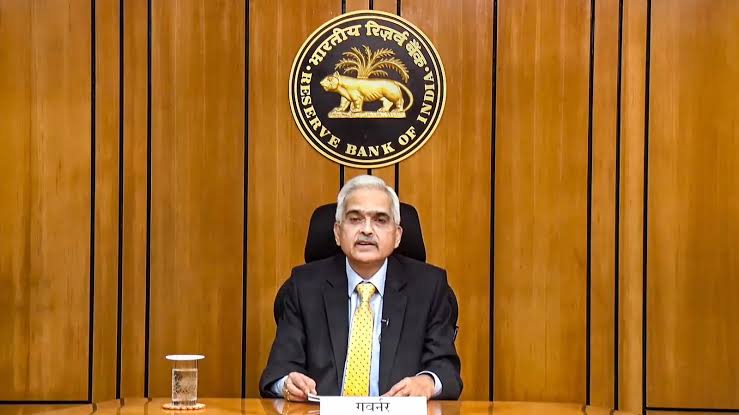

The Reserve Bank of India (RBI) on 8th Feb 2023 hiked the repo rate (the rate at which the RBI lends money to commercial banks) by 25 basis points (0.25%) to 6.50%. This means that the commercial banks will now have to pay a higher interest to the central bank. Therefore the loans will become expensive upto 2%.

This is the sixth consecutive raise in repo rate since May. Earlier, in December 2022 RBI had increased the repo rate by 35 basis points (0.35%) to 6.25%.

During high inflation in the economies central banks increase key lending rates. Hiked key lending rates lead to high interest on loans paid out by commercial banks. Usually increased rate also seems to negatively impact stock and debt markets- as it hikes interest rate, companies borrowing costs affecting the growth. However, with decrease in inflation central banks are likely to lower interest rate hikes.

Unprecedented events of the previous three years have forced the central banks across the world, including the RBI, to raise interest rates rapidly. Due to the unsound monetary policy framed by the central banks post covid-19- inflation went up to several decade highs in the developed nations across the globe. Thus, central banks have arrived at this decision to control high inflation.

As per the Economic Survey report, released on 31st Jan 2023, India’s GDP is likely to be in the range of 6% to 6.8% in the financial year 2023-24. In the Current fiscal year, India’s economic growth is expected to go up by 7%.

The RBI’s decision to increase lending rates by 0.25% is considered as a measure to prevent, the depreciation in rupee value and manage import-driven inflation. This will have an impact on housing loans EMI. As banks, housing finance firms and other lending companies have got the liberty to raise interest rates on loans, mainly home loans.

However, now commercial bank’s interest rates on fixed deposits (FD) are likely to go up and attract more savings. Repo rate hike is also expected to boost returns of debt mutual funds.