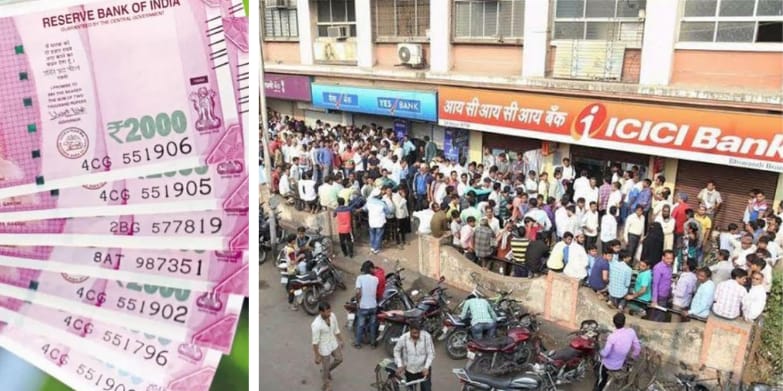

The Reserve Bank of India (RBI) made an announcement on Friday regarding the withdrawal of the highest value currency notes circulation in India. It said that the existing notes of 2,000 denominations can be exchanged or deposited to an extent of “₹20,000 at a time” in the banks till the end of September month.It advised all the banks to stop issuing ₹2,000 notes to the public and to redesign all the ATMs and cash recyclers.

RBI claimed that – “To safeguard the ongoing operations in the banks and to stop the confusions in the regular activities of the bank, they have set the limit to exchange the 2000 rupees currency notes and has been restricted to an amount of Rs.20,000. To conclude this exercise of exchanging the highest currency value note in a timely manner and to provide sufficient time frame to the people, all branches shall exchange and can accept deposits of 2,000 rupees notes until 30th September 2023”.

The Central Bank said- “Public can deposit money in their bank accounts as per the normal routine, concerned to the present instructions and the related provisions”.

As per Section 24(1) of The RBI Act, 2000 rupees notes were introduced in November 2016 with the primary objective of meeting the requirements of currencies after the withdrawal of ₹500 and ₹1000 notes in the country. After fulfilling that objective, the printing for 2000 rupees notes was stopped in 2018-19 and the other denominations were made available to the public in reasonable quantities.

The majority of Rs 2000 denomination were issued by RBI prior to March 2017, the estimated lifespan of around 4-5 years has come to an end and those notes are not used in the regular transactions now. Moreover, there is enough stock of notes in the other denominations to fulfill the requirements of the currencies.

The RBI has withdrawn the circulation of 2000 notes with the view of implementing the ‘Clean Note Policy’ in the country. This Policy seeks to provide good-quality currency notes and coins to the public with greater security features, while the other spoiled and damaged notes which were issued prior to 2005 are being withdrawn from circulation because those notes have very less security features when compared to the notes that were printed after 2005.

The exchange facility for Rs 2,000 notes is restricted up to Rs 20,000 at a time, the public can exchange notes in any of the bank branches, the notes will also be exchanged in the 18 Regional offices of RBI which have Issue Departments from 23rd May.

With reference to the recent announcement by RBI, Delhi CM Kejriwal tweeted in Hindi saying- “In the beginning they said corruption will end with the circulation of 2000 notes, but now they are banning the same stating that corruption will end. The PM should be educated, he doesn’t understand anything and the public suffers”.